how are property taxes calculated at closing in florida

Further for all other types of transfers in Miami-Dade County there. Based on the median home.

Closing Costs For Home Sellers Bankrate

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

. Florida sellers should expect to pay closing costs between 62590 of the homes final selling price including real estate agent commissions. The average property tax in Florida is an annual 173300 considering a home worth a median of 18240000 in value. In Miami-Dade County its calculated at a rate of 70 cents per 100 of the property value on the deed.

This will give you the money that you owe in property taxes. Figuring out the amount of your doc stamps. For comparison the median home value in Florida is 18240000.

Calendar Year taxes 1117 123117 411775 Ad Valorem Taxes. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Everywhere in Florida outside of Miami-Dade County its calculated at 60 cents per 100 of the value on the deed.

4200 12 350 per month. Ad Look Up Any Address in Florida for a Records Report. Since property taxes are based on the prior year when the tax bill finally comes all parties involved should re-prorate the taxes in order to determine who owes what.

With respect to how property taxes are handled and paid at the closing in Florida effectively the property taxes are paid by the seller through the date of the. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Take your property tax rate and multiply it by the value of the property.

In Miami-Dade County however the stamp tax rate is 60 per 100 or a rate of 06 for transfers of single-family residences. 16291 Sarasota County Fire Rescue a Non-Ad Valorem assessment 428066. Proportion Calculation - X sellers of days total amount tax 365 days.

This proration accounts for the time that the Seller still owned the. In Florida transfer taxes are also referred to as documentary stamps or doc stamps and theyre typically paid by the seller. Generally at closing the Seller pays property taxes dating from January 1 of that year until the date of closing.

The remaining 20000 of your propertys value is taxable because its less than the 50000 minimum to be eligible for the additional homestead exemption. As will be covered further appraising property billing and collecting payments conducting. Counties in Florida collect an average of 097 of a propertys assesed fair.

Plus the state is still ranked as the 23rd in the nation in terms of the average amount of property taxes collected. Find Records For Any City In Any State By Visiting Our Official Website Today. While the nationwide average property tax rate is 11 of the average home value Florida counties collect an.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. While observing constitutional limitations prescribed by statute the city creates tax rates. This is an easy formula that you can use to quickly get the prorated property tax that you can advise to your.

Divide the total annual amount due by 12 months to get a monthly amount due. For the Florida median home value of 252000 this comes to 1512 outside of Miami-Dade or 1764 inside Miami-Dade. Here is an example assuming a Closing on March 1 2018 for a property actually selling for 465000 having a Taxable Value of 325500 and having gross Total Taxes Assessments of 445216.

All legal Florida residents are eligible for a Homestead. See Results in Minutes. Heres how to calculate property taxes for the seller and buyer at closing.

Are Closing Costs Tax Deductible On Rental Property In 2022

:max_bytes(150000):strip_icc()/howhomevalueisassessed-f1f98b53f65943d8bda8304d43175cfa.png)

Learn How Property Taxes Are Calculated

Property Tax Calculator Smartasset

Closing Costs Calculations Practice Video Lesson Transcript Study Com

Closing Costs Calculations Practice Video Lesson Transcript Study Com

About Florida Homestead Check Explaining Florida S Homestead Laws

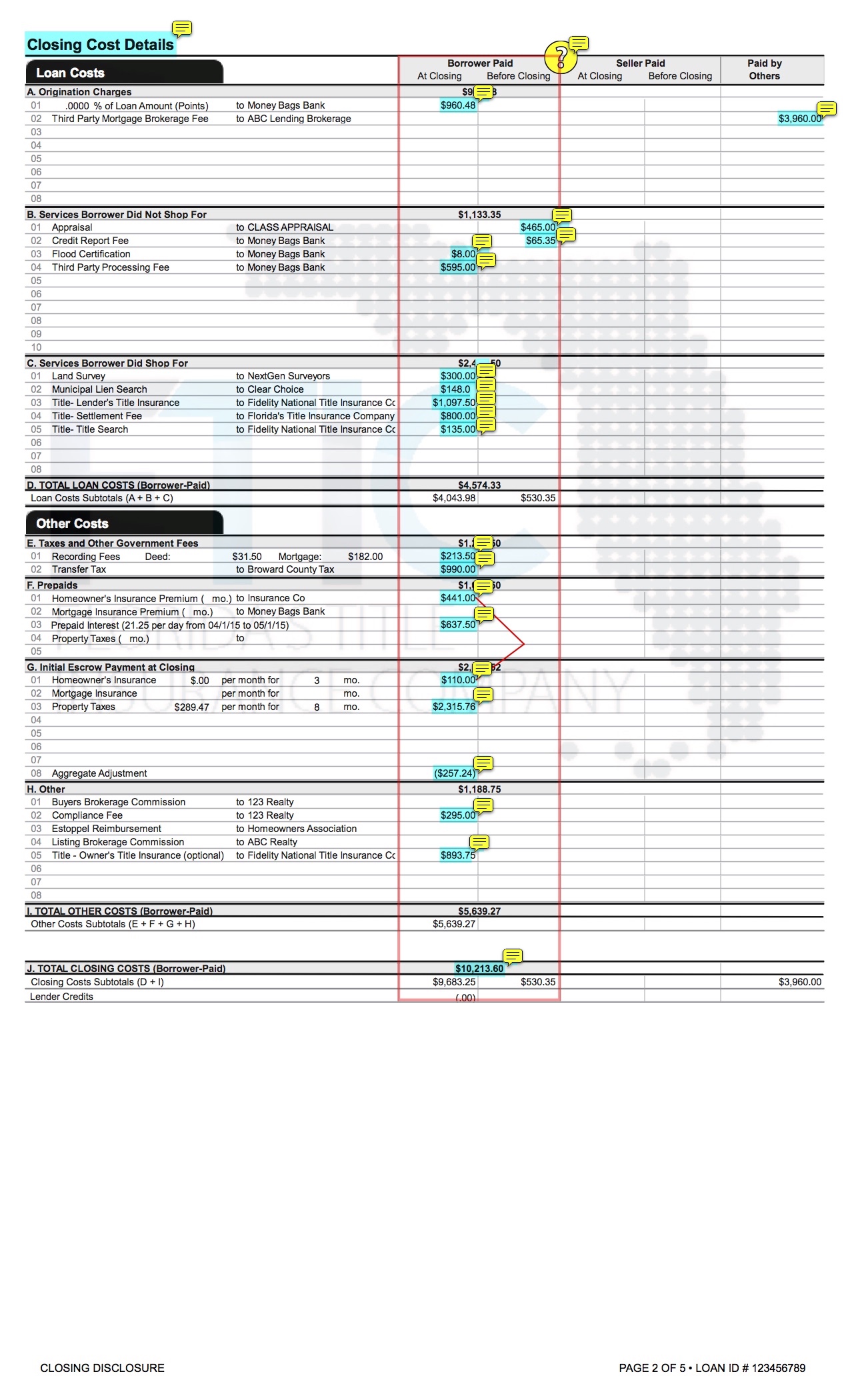

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

About Florida Homestead Check Explaining Florida S Homestead Laws

The True Cost Of Selling A House In Florida Revealed 2022 Update

Closing Costs Calculations Practice Video Lesson Transcript Study Com

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Closing Costs In Florida What Sellers Need To Know

How Much Are Closing Costs In Florida

A Guide To Closing Costs Blog Jennifer Ferland

Property Taxes Expected To Spike For New Homeowners

Handling Property Taxes At A Closing In Florida What Do I Need To Know

Your Guide To Prorated Taxes In A Real Estate Transaction

Closing Disclosure Forms 101 South Florida Legal Tools Asr Law Firm